FXTM Account Types

Home » Account Types

Available Account Types

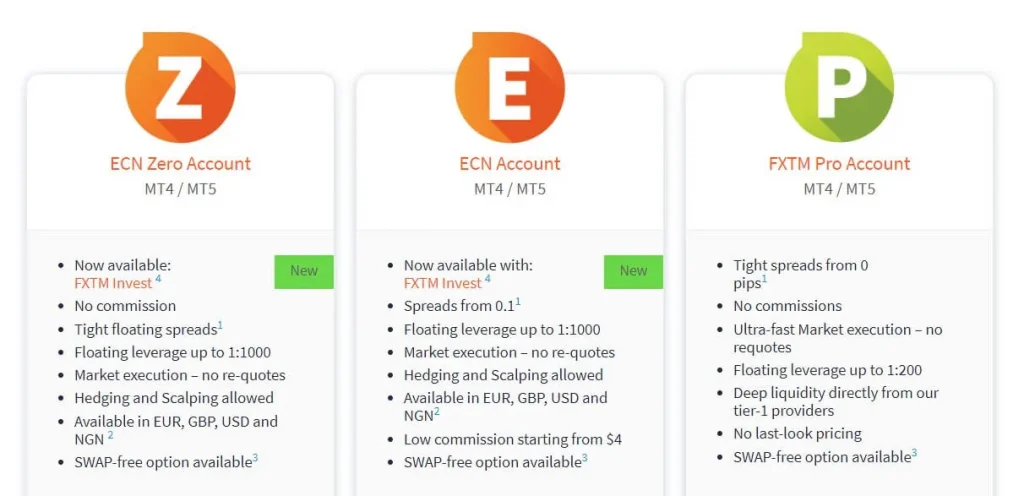

FXTM Malaysia offers a range of trading accounts to suit different needs. The Standard account provides entry-level access with a minimum deposit of MYR 42, spreads starting from 1.5 pips, no commission, and maximum leverage of 1:1000. For more advanced trading, the ECN Zero account requires MYR 2,130 minimum deposit, offering tighter spreads from 0.1 pips with a MYR 15 per lot commission and 1:500 leverage.

Educational Resources

Each account type provides access to comprehensive educational materials. Trading webinars and workshops support skill development at all levels. Market analysis tools help traders make informed decisions. Technical support assists with platform navigation and feature utilization. Regular trading updates keep clients informed of market opportunities.

Client Support Services

Department | Services |

Account Support | Account setup, maintenance, general inquiries |

Language Services | Multi-language assistance and translation |

Technical Support | Platform guidance, trading system help |

Financial Team | Payment processing, fund transfers |

Compliance | Regulatory matters, verification assistance |

Standard Account Features

Key characteristics of Standard accounts:

• Minimum deposit: MYR 42

• Market execution

• No commission trading

• Standard market spreads

• Full EA support

• Mobile trading access

• MetaTrader 4 platform

• Multiple currency pairs

Security Protocols

Account security measures include multi-factor authentication and encryption protocols. Regular security audits ensure protection of client funds and personal information. Automated monitoring systems detect and prevent unauthorized access attempts. Segregated client accounts maintain full fund separation. Emergency protocols protect trading operations during market volatility.

Account Upgrade Process

Traders can upgrade their accounts as trading requirements evolve. Upgrade requests undergo verification to ensure eligibility for new account types. The transition process maintains all existing trading settings and history. Additional features become available immediately after successful upgrades. Support team assists with optimization of new account features.

ECN Account Specifications

ECN accounts provide direct market access with:

• Raw spreads from 0.0 pips

• Commission-based trading

• Instant execution

• Deep liquidity

• Professional tools

• Advanced charting

• Premium analytics

• Expert support

Islamic Account Provisions

FXTM Malaysia offers specialized Islamic trading accounts compliant with Shariah law. These accounts operate without swap charges on overnight positions. Our Islamic accounts maintain the same trading conditions as standard accounts while adhering to religious principles. The verification process includes additional checks for Islamic account eligibility. Dedicated support staff assists with Islamic account management and compliance questions.

Professional Account Benefits

Professional traders at FXTM Malaysia receive enhanced account conditions with higher leverage options and reduced margin requirements. The professional status requires verification of trading experience and financial knowledge. Our professional accounts provide priority support and customized solutions. Advanced trading tools and premium analytics become available with professional status. Regular account reviews ensure continued eligibility for professional benefits.

Demo Account Options

Available demo account features:

• Virtual balance: MYR 42,000

• Risk-free practice environment

• All trading platforms access

• Real market conditions

• Full feature testing

• Strategy development tools

• Technical analysis tools

• Educational resources

Corporate Trading Solutions

FXTM Malaysia provides comprehensive corporate account solutions for institutional clients. The minimum deposit requirement starts at MYR 21,300 for corporate accounts. Business verification includes thorough documentation review and compliance checks. Corporate accounts receive dedicated relationship managers and customized trading conditions. Multi-user access management ensures secure corporate trading operations.

Account Management Tools

Each account type includes advanced management features for efficient trading operations. Portfolio analysis tools help track trading performance across multiple instruments. Risk management systems provide real-time monitoring of open positions. Automated reporting systems generate detailed trading histories and performance metrics. Account holders receive regular updates on market conditions and trading opportunities.

Trading Platform Integration

FXTM Malaysia accounts integrate seamlessly with MetaTrader 4 and 5 platforms. Cross-platform synchronization ensures consistent trading experience across devices. Mobile trading applications provide full account functionality on smartphones and tablets. Advanced chart packages and technical analysis tools are available on all platforms. Real-time market data feeds support informed trading decisions.

Frequently Asked Questions

Consider your trading style, initial investment amount, and preferred instruments. Standard accounts suit beginners with MYR 42 minimum deposit, while ECN accounts offer professional conditions with MYR 2,130 minimum deposit.

Yes, account upgrades are available upon meeting minimum deposit requirements and verification criteria. Contact our support team for assistance with account transitions.

Standard accounts require government ID and proof of residence. Additional documents may be needed for ECN and corporate accounts, including financial statements and company registration documents.